Desperation smells. Interviewers can sense it.

Strong finances mean you can walk away from bad jobs — and bad bosses.

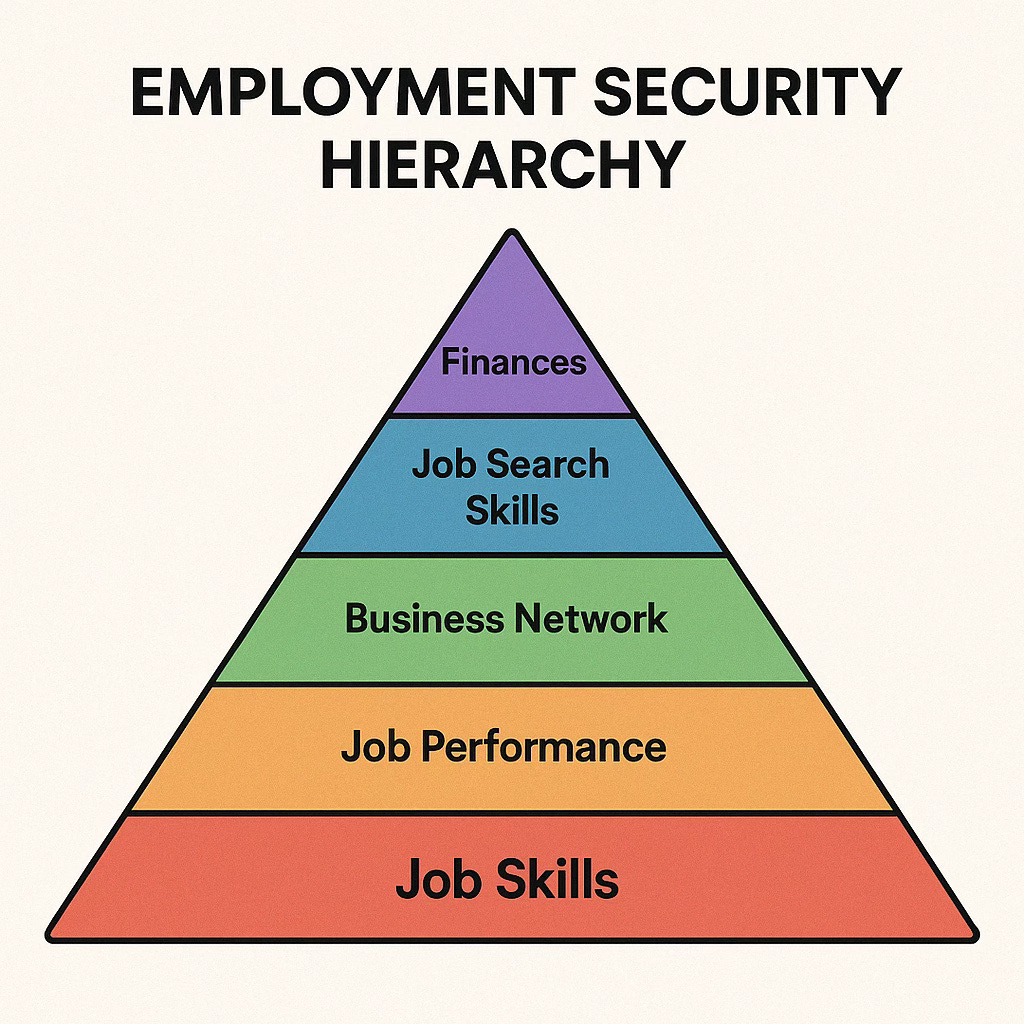

Finances are at the very top of the Employment Security Hierarchy. Here is why your finances are so crucial to Employment Security: Desperation.

In previous newsletters, I’ve written about Job Skills, Job Performance, Business Networks, and Job Search Skills. Here’s a quick look again at the hierarchy.

Yes, desperation. That feeling you get in the pit of your stomach when you are desperate to get a job. That desperation is like blood in the water to the interviewing shark. That feeling of despair that comes from accepting a job -- any job -- even though you know the job is not a good match, the boss isn’t that great, and the company stands for everything you are against.

It’s a paycheck. But that’s like trading silver for your life in the long run.

Your finances separate you from that values-compromised, stressful, relationship-killing trade.

Your finances allow you to choose what job you take. They allow you to hold out for something closer to your skills. They give you the maximum choice if your company offers early retirement, or you’d be willing to take a voluntary package. They give your family personal security so they can continue their lives as a family and not make the harsh choices that come from desperation.

This newsletter focuses on helping knowledge workers navigate corporate America, from searching for jobs to working in the role, having employment security, and helping you become a Cubicle Warrior.

Navigating Corporate is a reader-supported publication. There are no investors. No sugar daddies. Just me. And the cats.

To receive new posts, become a free or paid subscriber.

Financial goals are simple, but hard to obtain

I always consider personal financial goals simple: little debt, living below your means, and one year’s take-home pay in the bank. Your finances are a great buffer to economic chaos, and there is a lot of economic chaos out there to buffer against.

Layoffs are happening now; it’s not a job seeker’s market (See: DOGE). The time to get back to work is getting longer. I have former coworkers looking for their next position for 5+ months.

Just this morning, I looked on LinkedIn to see a person who received a President’s award from his company and was laid off three months later. He was in the wrong place at the wrong time. This person has been out of work for 14 months.

The work to become debt-free, live below one's means, and save money for the inevitable new job search must start today.

Here’s your practice test

Want a great test of your financial ability to hold back the storm? Calculate your unemployment benefits for six months -- 26 weeks from the state only -- and then live on that plus your savings (put your paycheck in a separate place for the test) for those six months.

You know your paycheck is coming in the door, but watch how fast you have to dip into your savings if you were laid off instead of practicing a layoff. Find out where your finances are weak -- and where your relationships are as well, because there isn’t as much money coming in the door, and money changes your relationships.

Most people live paycheck to paycheck, and some people right now have to live paycheck to paycheck. Living paycheck to paycheck is a terrible place to be, and anything you can do to get out of that situation by cutting costs, eliminating debt, and saving money is critical to Employment Security.

Practice the layoff. It is an eye-popping experience.

Be a Cubicle Warrior,

Scot